As is the case in most industries, technology is driving innovation for financial services firms. It is increasingly recognised as an essential part of the sector's collective efforts to ensure processes are as efficient as possible and the needs of clients are comfortably met. From advisers right through to consumers - the benefits are impacting all parties. It isn't enough, however, to simply expand the IT budget and secure the latest applications.

As is the case in most industries, technology is driving innovation for financial services firms. It is increasingly recognised as an essential part of the sector's collective efforts to ensure processes are as efficient as possible and the needs of clients are comfortably met. From advisers right through to consumers - the benefits are impacting all parties. It isn't enough, however, to simply expand the IT budget and secure the latest applications.

Making the most of this huge digital opportunity requires immaculate preparation and robust strategies for both implementation and ongoing use. Your technology system should also meet certain standards, and the following ten components are the perfect place to start.

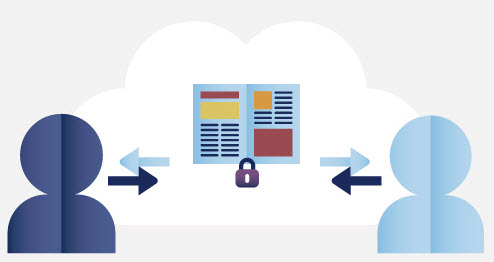

Secure

We live in an age where data is valuable and cyber-crime is common. While it can affect any connected business, it's easy to argue that the risks are even more prominent in the financial sector. With sensitive information being passed back and forth between advisers and theirs clients on an hourly basis, steps must be taken to ensure all correspondence is secure. When client data is at risk, so too is the reputation of the business. Email should be the most obvious focus here, and having a robust encryption solution in place is a must.

Immediate

Everything moves quickly today - busy consumers expect instant action and even quicker results. If advisers are to respond appropriately, everything technological must enable things to happen immediately and with as little human intervention as possible. Automation plays a key part here; important updates should be downloaded automatically and the system should be refreshed constantly to ensure everything is up-to-date and ready to go at all times. As soon as the user is required to get involved in maintaining the system, operations are likely to slow.

Multi-third party connectivity

Your technology system will be made up of various elements, all of which, when required, must be able to work together as though they're one single solution. To a certain extent, this interoperability should extend to third-party systems too. This can be as simple as ensuring files are compatible across the systems used by your company and those of another business - be it a partner or client. Many of the major third-party programs - like those from Microsoft and Google - will be designed with users' own systems in mind, but think about the financial sector-specific examples too.

Regulatory

While not completely unique to the sector, regulatory compliance is a particularly significant concern for adviser businesses. With consumers' needs in mind, the Financial Conduct Authority (FCA) is constantly monitoring the industry and making changes. Technology can play a vital part in supporting an adviser’s constant drive to achieve this. Systems can help with risk profiling, while both client-facing and MI reports can help guarantee compliance.

Informative

Data is the fuel on which the average modern business operates. With accurate information to hand and the right tools with which to analyse it, firms have the power not only to streamline their own processes but to dramatically improve the services they provide for their clients. As a financial services company, your technology system must be powerful enough and configured appropriately to collect this data and present it in a way that is both easy to digest in building a more profitable business and, ultimately, useful.

On top of this, there should be a strong focus on making everything instantaneous. Data has a shelf-life; as time goes on, its usefulness diminishes. When information is presented in real-time, firms have the chance to put it to optimum use.

Efficient

Technology has plenty to offer the average business, but its power to improve efficiency is perhaps the biggest selling point. Ever since the recession hit in 2008, streamlining has been a major focus for financial advisers - cutting expenditure is the only way to overcome the new challenges that have hit almost every industry, and removing unnecessary processes is by far the best way to start.

Once again, this is where automation comes in. If an online form is filled in during one part of the process, for example, there's no need to go through the same thing again. If the system works in harmony as it should, this kind of information will be reused automatically.

Adaptable

The business's needs will change from day-to-day in the same way that its clients' will – and the tools at hand must reflect this. Internally, they should be usable by you and anyone else involved in the company – this may involve a separate accountant or assistant. Of course, permissions can be changed to create different access levels, but the same systems and interfaces should still be present nonetheless.

Accessible

The adaptability mentioned above also extends to the external side of the business. We already live in a digital world, but the influence of technology on peoples' lives is only going to become more intense as time goes on. It's not out of the question to suggest that within the next decade being online will become the default state for most people and devices, and that most tasks will be carried out over the web without any real thought. The client-facing side of the company's technology system, therefore, should be as robust and useful as its personal, face-to-face equivalent.

Business focused

Like any other investment, an adviser's technology system should be conducive to the business's long-term development. The immediate idea is, of course, to provide clients with a better service, but this in itself should help overall growth. Think about where the industry as a whole is headed and ensure the solutions being adopted are able to assist on the journey. With this in mind, everything should be tailored to the sector and the unique challenges that businesses within it face.

Future-proof

It hasn't been long since the financial sector was altered forever by the introduction of the FSA's Retail Distribution Review (RDR). This was a huge change for businesses to deal with, but it won't be the last. As the industry evolves over time, firms must be in a position to adapt. Scalability is also something to consider; even without the external influencing factors, businesses must be prepared for both growth and contraction as time goes on. The introduction of the cloud helps greatly here, as does mobile technology.

All of the above may seem like a lot to consider, but with such huge potential, it makes sense to get your use of technology right first time.

|

| |

|---|---|

|

|

|