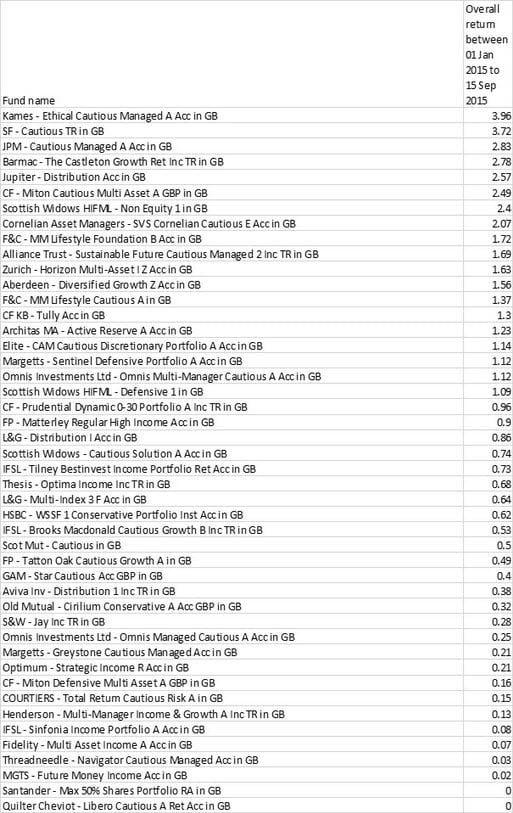

Only 19 cautious funds have managed to return in excess of 1 per cent year-to-date, while only 46 funds from 150 cautious funds have managed to avoid losses at all this year (zero per cent or higher return).

As autumn firmly entrenches itself upon us, investors reflecting on the year so far could be forgiven for wondering what else might be in store for the markets. 2015 has certainly proven a bit of a rollercoaster – between tensions over the UK election, the ongoing saga that is the Greek debt crisis, the unprecedented slump in oil prices and then a summer of turmoil on the back of concerns over China’s ability to continue to prop up the global economy.

While the markets attempt to regain lost ground from this summer’s equity market slump, the impending interest rate rise continues to hang over investors’ heads – which can only mean they face more market volatility as speculation over just when the Federal Reserve and the Bank of England will hike rates from their historically low levels.

With all of this going on investors have sought to reposition portfolios and have taken a more cautious position. However, with just under a third of cautious funds managing to avoid losses, nervous investors may be left wondering where to turn to next!

FE Analytics data shows just 19 funds within the Investment Association universe with a cautious investment style have provided a return in excess of 1 per cent this year (numbers correct from 01/01/2015 to 15/09/2015), while only 46 out of the 150 funds have avoided losses this year.

The cautious fund that has managed to return the most this year has been the high-rated Kames Ethical Cautious Managed fund. The five FE Crown rated fund, managed by Audrey Ryan and FE Alpha manager Iain Buckle, has returned 3.96 per cent overall year-to-date.

In second place is the SF Cautious fund with 3.72 per cent, with the JPM Cautious Managed fund in third with 2.83 per cent, according to FE data.

The cautious funds that have managed to avoid losses this year: