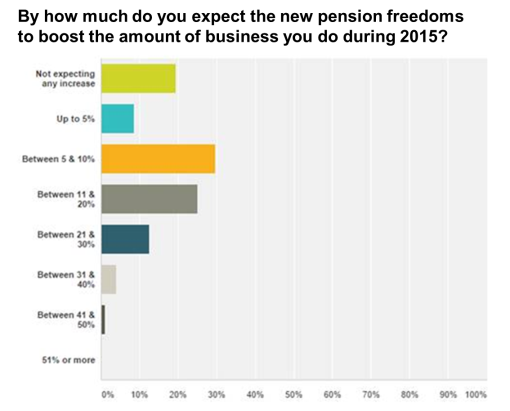

A new poll¹ among users of Intelliflo’s Intelligent Office web-based business management software shows that four out of five adviser firms expect the new pension freedoms to provide a significant boost to business.

Over half (55%) believe it will stimulate an upturn of between 5% and 20%, while almost one in six (18%) predict a business uplift of between 20% and 50%. Intelliflo estimates that a 20% increase in business would equate to around £765 million of additional revenue across all UK advisers².

The results follow a previous survey³ carried out by Intelliflo in November last year, which showed almost three quarters (73%) of the respondents believed that many or some of their clients would be interested in taking all their money out of pensions, with more than a quarter (26%) saying it will be of interest to many.

A third (32%) believed the changes make it more likely their clients will take the tax free cash from their pensions at a younger age than a few years ago. Asked how that tax free lump sum might be used, just over one in 10 (11%) said they thought it would be invested in property, with almost one in three predicting it would be used to pay off debts (28%) or to improve their clients’ lifestyles.

At the time of the November survey two in five (40%) reported they had already experienced increased business for their firm as a direct result of the government’s proposed new pension rules.

Nick Eatock, Intelliflo’s Executive Chairman comments: “Our survey shows that advisers are optimistic about the business opportunities that could arise from the new pension freedoms when they come into operation. However, just a few months ago we found that many are also concerned that some of their clients may not be able to resist the opportunity to dip into their pension savings, leaving them with reduced funds to provide adequate investment to fund later life. It’s going to be interesting to see how advisers and their clients rise to the challenges that the new rules will inevitably present.”

Click here to view our infographic

Notes for Editors

¹ A survey of Intelliflo users carried out during February/March 2015, with a sample size of 176.

² Calculation based on adviser data published by the Association of Professional Financial Advisers for 2013 (http://www.apfa.net/documents/publications/financial-adviser-market/apfa-the-financial-adviser-market-in-numbers-v2.0.pdf). Calculation used consolidated revenue for all regulated business at £3.826 million (fig. 10) as base figure.

³A survey of 227 users of Intelliflo’s Intelligent Office carried out during October/November 2014.

About Intelliflo

Intelliflo (www.Intelliflo.com) has been providing information technology services to financial services companies since its formation in 2004. Its leading web-based business management software, Intelligent Office, helps financial businesses large and small to improve efficiency and increase profits. Intelligent Office supports over 1,320 firms and 11,450 users with assets under advice of £181 billion (as at 31 December 2014).

In July 2013 HgCapital, a leading European private equity investor in B2B technology companies, became a majority shareholder in Intelliflo Ltd. HgCapital has a wealth of expertise in developing web-based software businesses and is committed to supporting the next phase of Intelliflo’s growth.

In March 2015 Intelliflo was listed among the top 25 best performing privately owned technology companies in the UK mid-market. The list is compiled by Megabuyte’s independent and highly-regarded research team and is based on financial performance and long-term potential.